%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

Our earlier blogs explained the purpose of the Regulatory Initiatives Forum and the regulatory agenda for 2022. This edition of the Grid provides further updates.

What’s new in this 5th edition of the Grid?

Nikhil Rathi, CEO of the Financial Conduct Authority Sam Woods, Deputy Governor, Prudential Regulation, Bank of England (BoE)

Significant Developments, perhaps a phrase that an already stretched compliance team doesn’t wish to hear. Fortunately, those firms that keep an eye on the regulatory horizon will already be aware of these significant developments. These refer to the Financial Services and Markets Bill (the Bill) which will help shape the UK’s future regulatory framework.

The Bill announced in the Queen’s Speech will implement certain changes including:

- New secondary objectives for the FCA and PRA pertaining to growth and international competitiveness

- Reforms for the UK capital markets

- Protecting access to cash

- Introducing new consumer protections

- Harnessing innovation

All of the above topics have been mentioned previously either by the UK Government in key speeches or via the Forum’s previous meetings.

One area of future collaboration focuses on the increasing costs of living. The Forum anticipates further work in the area. It will see the Forum working with the Money and Pensions Service (MaPS) and it's likely that we'll see new initiatives borne out of this collaboration.

The Grid helps to highlight key areas of regulatory work; firms are encouraged to scan the regulatory websites for any specific updates ahead of any messages from the Forum.

Key Items for 2022-2024:

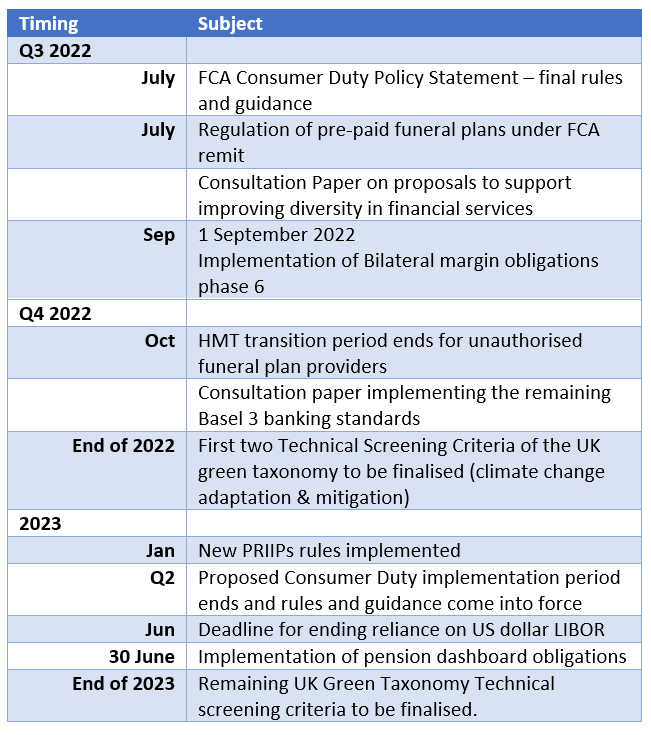

The table below highlights key initiatives that impact the regulatory agenda.

From this edition of the Grid, we see progress on the ESG initiative. At the time of writing, the FCA is due to issue its feedback statement regarding sustainability disclosures and further consultations on diversity and finalising green screening criteria.

Regarding the Appointed Representatives Regime, HMT’s Call for Evidence closed in March and we can expect a policy statement in Q3.

Work on transforming regulatory reporting is in progress and is set to continue for some time. Dual regulated firms have received regulatory communications in 2022, but later this year solo regulated firms can expect to see some interaction.

We can’t forget Operational Resilience. Following the March 2022 milestone, further consultation is expected in Q2/Q3 2023, relating to incident reporting and third-party management.

How Ruleguard can help you:

Ruleguard for Third Party Oversight takes the core benefit of the Ruleguard platform – powerful rules-mapping and evidencing – and uses it to bridge the gap between a firm and its third parties. A seamless control environment between you and your third parties for genuine oversight: https://www.ruleguard.com/third-party-oversight.

Contact the Ruleguard team to learn more on 020 3965 2166 or hello@ruleguard.com.

Ruleguard hosts regular events on a various regulatory topics.

To register your interest or learn more, please click here.

White Papers:

Request a complimentary copy of our White Paper on Best Practice in Third Party Risk Management click here.

Further resources:

See our blog page for further articles or contact us via: hello@ruleguard.com

Visit our website to find out more about how Ruleguard can help: https://www.ruleguard.com/platform

Head of Client Regulation| Ruleguard