%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

The Appointed Representative Regime (the Regime) was introduced in 1986 initially for investment services. With the introduction of the Financial Services and Markets Act 2000 (FMSA), the Regime’s scope was broadened.

The aim of the Regime has always been to provide a balanced and cost-effective way for firms to enter the market without seeking individual authorisation. In this way, it supports the regulatory objectives by encouraging greater competition and innovation.

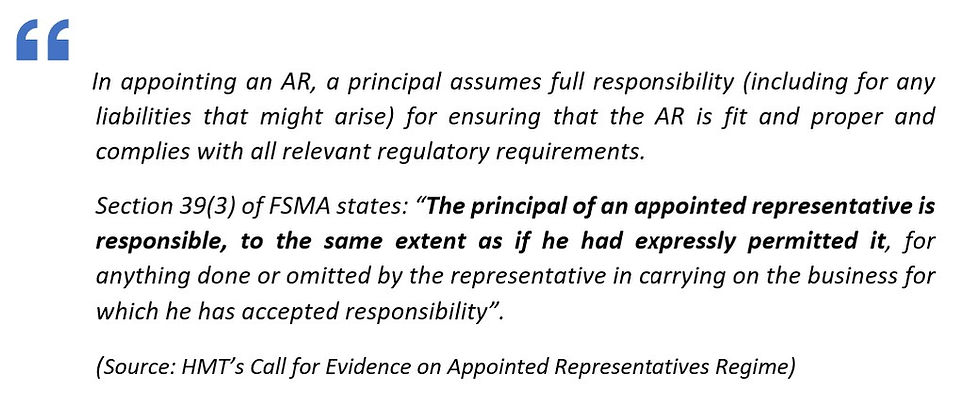

However, it still requires oversight of the appointed representatives (ARs) to ensure that customers are not disadvantaged or exposed to additional risks. This responsibility lies firmly with the Principal firms (Principals). Principals need to ensure that any individuals, or firms, appointed by them operate in an appropriate manner when providing regulated services.

Why do we need a tougher regime?

The FCA’s thematic reviews indicated that some Principals don’t understand their regulatory obligations relating to ARs.

The FCA voiced its concerns in its consultation paper. From its thematic reviews of various sectors, the regulator has highlighted the following areas:

- Provision of misleading information provided to consumers increasing the risk of harm

- Provision of products and services which are not appropriate for the target audience

- Inability to identify harm and take remedial action

- Operating outside the boundaries of permitted activities

In addition, the UK Government’s own Call for Evidence has indicated that the Regime’s scope has widened beyond its original purpose. Hence the need for reform.

It’s worth remembering that ARs performing regulated activities are not authorised or supervised by the FCA. Consequently, the ARs need to understand and comply with the regulatory requirements for the regulated activities they are engaged in. The Principal firms have a role to play in educating the ARs and ensuring that they have appropriate oversight and regular monitoring in place. In turn, Principals must have appropriate skills and resources to enable effective oversight and monitoring. This is particularly important where an AR’s activities may be slightly different from that of their Principal. For example, regulatory hosting services, one area of particular regulatory concern. The ARs need to provide Principal firms with timely, accurate and relevant information as well as permit monitoring to take place.

Reporting & notifications shake-up:

For some, regulatory reporting will be less onerous, but for others, more data is required. For example, some of the requirements include:

- Principals needing to provide more detailed information regarding the relationship with the AR, including background information relating to any prior Principal links and the reasons for the termination

- Significant changes need to be reported to ensure data is maintained and notifications made within specified timeframes

- AR Relationship notification requires 30 calendar days notice to be given before an appointment takes effect, and also applies to IARs

- AR notification and Form As for approved persons need to be submitted at the same time

- Principals will need to verify their ARs on an annual basis and ensure the accuracy of data on the FCA register

- Principals need to complete regular self-assessments

Future changes:

Further measures are still under discussion, so it’s not over yet.

For example, the Government’s Call for Evidence mentioned a ‘Principal permission’, whereby Principals must be granted the permission to act as a Principal rather than merely submitting a notification to appoint a firm whenever it’s required.

To encourage higher standards, extending the scope of the Senior Managers & Certification Regime to include the ARs is also under consideration. This would require amended legislation and there is still some way to go before any decisions are made.

Regardless of that, Principals still need to comply with the overarching Principals for Businesses. This means identifying and managing risks, completing due diligence, and confirming the fitness and propriety, as well as the competency, of people acting on its behalf.

Timeframes:

Meanwhile, the following changes will be implemented from 8 December 2022:

- Collecting data from ARs and enhancing Principal reporting to the FCA

- Clarifying and strengthening the responsibilities and expectations

It’s important to ensure that the Regime remains fit for purpose and is aligned with the FCA’s focus on consumer protection, market integrity and competition.

End Goal:

The FCA has stated that it seeks to achieve the following outcomes:

- Principals understand their responsibilities in relation to ARs, have stronger and better oversight of, and take more effective responsibility for, their ARs

- FCA can better challenge firms with, and those looking to appoint, ARs

- Principals address problems with their ARs that are, or have the potential to, cause harm to consumers or markets

- Consumers can access better‑quality information on principals and ARs and make good decisions when choosing products or services

Principals and ARs are firmly on the regulatory radar and we need to watch this space for further developments.

If you’re a Principal or AR, you need to ensure that you’re on the same page as the FCA - and the Government!

Ruleguard can help Principal Firms & Appointed Representatives

Ruleguard for Third Party Oversight takes the core benefit of the Ruleguard platform: powerful rules-mapping & evidencing, and uses it to bridge the gap between a firm and the third parties that it works with.

Any information maintained within the Ruleguard system can be selectively shared with others. As information changes over time, differences are automatically highlighted to ensure that up-to-date records are being maintained.

Ruleguard allows Principal Firms to map received information, letting you incorporate third party regulatory information into your own risk or monitoring frameworks. For example, you can generate and automatically maintain compliance documents that reference third party controls, clearly labelled with the AR that operates them, within your account.

This has the ability to radically transform the third party oversight capabilities of a compliance function and allow it to extend best practice beyond the borders of the firm.

To find out more, please contact us for further information on: Tel: 020 3965 2166 or hello@ruleguard.com.

Webinars:

Ruleguard hosts regular events on a various regulatory topics.

To register your interest or learn more, please click here.

Request a complimentary copy of our White Paper on Best Practice in Third Party Risk Management click here.

Further resources:

See our blog page for further articles or contact us via hello@ruleguard.com

Visit our website to find out more about how Ruleguard can help: https://www.ruleguard.com/platform

Head of Client Regulation | Ruleguard

.png?width=300&height=175&name=webinar%20featured%20image%20April%2025%20-%20How%20can%20firms%20improve%20compliance%20monitoring%20v1%20large%20(5).png)

.png?width=300&height=175&name=webinar%20featured%20image%20April%2025%20-%20Avoid%20the%20pitfalls%20proactive%20compliance%20monitoring%20v1%20large%20(1).png)