%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

Do we need to brace ourselves for another scandal followed by expensive remediation projects? How do we avoid that?

Consumer Duty's purpose:

The introduction of the Consumer Duty is a vital step in meeting the FCA’s 3-year business strategy driving good outcomes and evidencing compliance across a firm’s activities.

In simple terms, the Consumer Duty is about setting an overall standard, or benchmark, of behaviour for firms. See our earlier article: What is the Consumer Duty?

According to the FCA, it is supportive of consumer investing activities, but it wants to see it done “wisely and safely”. The FCA also believes that the markets don’t support consumer investing as well as they should. This belief is supported by the fact that consumers must make complex investment decisions about how and where to invest their monies, coupled with a wide-ranging choice of investment opportunities.

Additionally, there is the challenge of who to trust, given the wide range of small firms offering a range of services to consumers, with varying levels of competence. All these factors make it challenging for consumers to determine what good practice looks like. It is hoped that the Consumer Duty will improve trust and help consumers to make informed investments.

Why do the regulators hold this opinion?

Several factors contribute to the regulatory stance. If you hang around long enough, you’ll see similar mistakes happening, but in different sectors of the FS industry. The scandals in the FS industry stem from lack of risk management, ownership and robust governance. Additionally, you only need to look at the FCA’s figures to understand the concern:

- Over 8 million people have more than £10,000 sitting in cash, not earning any interest or return

- Almost 4 million adults have held investments that posed a higher risk than the losses they could bear

- In 2021, people lost £570 million to investment fraud and scams

Wouldn’t it be great if everyone played by the same rules? This brings us to the FCA’s Consumer Investment Strategy, published in 2021. This strategy sets out the FCA’s 3-year plan to address the above shortcomings, and The Consumer Duty complements that strategy.

Cross-cutting obligations:

Delving deeper, we hear mention of terms such as ‘cross-cutting rules’. This refers to the rules and guidance that are not specific to one sub-sector of financial services but all of them. These obligations, if met, aim to deliver good outcomes for the consumer.

Firms need to:

- act in good faith towards retail customers

- avoid causing foreseeable harm to retail customers

- enable and support retail customers to pursue their financial objective(s)

One word of warning!

Firms need to ensure that they can deliver these good outcomes across all areas of their business activities and ensure that the Consumer Duty is embedded in all areas of a firm’s conduct.

If you’re outsourcing certain activities or perhaps have partnerships with third parties, you’ll need to assess their impact upon your ability to fulfil your Consumer Duty obligations. Don’t forget they have the ability to affect your consumer relationship, and that with the regulator. You need to review your due diligence process when choosing partners, but don't forget due diligence should be completed on an ongoing basis to ensure compliance.

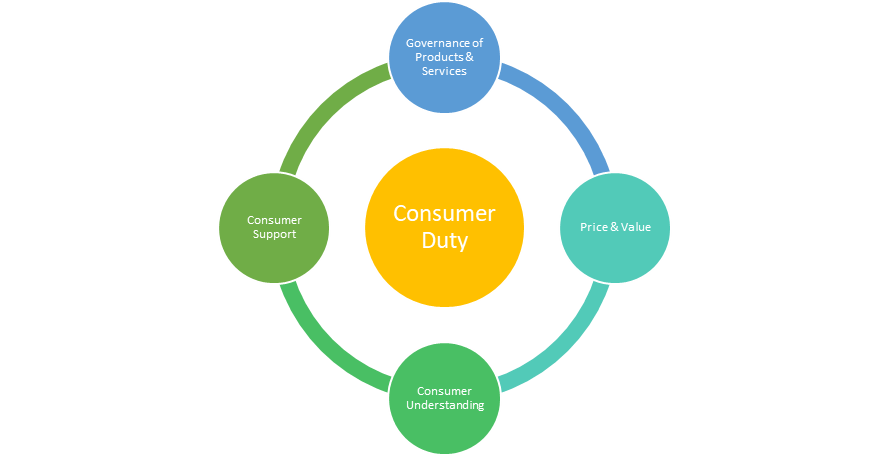

The outcomes:

Firms must get to grips with the FCA’s four outcomes specific to Consumer Duty. These outcomes detail the regulatory expectations on how firms should forge their Business-to-Consumer relationships. Firms need to be review the FCA’s final guidance, identify where their business processes fall short and plan how to address those weaknesses.

One area that firms struggle to understand is how the Duty applies to their business. You need to take reasonable steps to comply, but what does that mean?

It requires firms to look at what activities are being performed and identify any potential areas where they might cause harm to consumers.

Firms should be asking themselves:

- What types of products and services are being offered? What level of risk do they pose? Are they high risk products? How are they being marketed and sold?

- Who is the target audience? What are the characteristics of those customers?

- How do we identify, communicate, and assist vulnerable customers?

- Where does the business sit in the distribution chain? Is it providing services directly, or via a third party, to consumers?

It is when you drill down into the detail of the activities being conducted that a firm builds a picture of how Consumer Duty is likely to affect their clients. This then enables the identification of those systems and controls that need to be enhanced to meet the requirements.

Regulatory expectations:

The FCA is keen to emphasise that their views aren’t solely based upon reading a few implementation plans, but via discussions with those firms too. What will the regulator require post 31 July 2023?

What will the regulator require post 31 July 2023?

How can firms demonstrate that they are ready?

Implementing the Customer Duty is a step change and firms must act now to:

- Prioritise activities to concentrate on those areas with the greatest impact upon outcomes for customers

- Ensure that changes are made to improve communication to customers

- Deliver products and services that meet customers’ needs

- Provide support when needed

- Collaborate with any third parties to ensure all parties are delivering good customer outcomes

The FCA will be writing to firms highlighting its expectations and those areas of particular risk. It will also issue surveys to the small and medium sized firms for completion.

Act now!

Firms should consider the following questions:

- What governance arrangements do we have in place?

- How do we demonstrate ongoing oversight of the implementation plan?

- Can we deliver our plan, and implement it by our specific due date?

- What third party arrangements are in place and how do they affect our ability to deliver and implement our plan?

- How do we demonstrate that we continue to meet the four outcomes throughout the business?

- How do we embed, and demonstrate that the Consumer Duty is part of our ongoing strategy and culture?

Our Ruleguard solution

Ruleguard is an industry-leading software platform designed to help regulated firms manage the burden of evidencing and monitoring compliance. It has a range of tools to help firms fulfil their obligations across the UK, Europe and APAC regions.

Ruleguard has been designed to help firms demonstrate and evidence compliance, by using its comprehensive rules-mapping, risk and control tools, automated reporting features and powerful dashboards. Ruleguard can revolutionise how your firm undertakes compliance monitoring with best-in-class governance, oversight and management of compliance risk.

Evidence and approvals are gathered in real time, with responsible individuals signing off attestations within a framework designed for your firm. Documentation reviews and updates are managed automatically. Key operational workflows can be designed directly within the solution, ensuring that MI outputs are available which directly provide stakeholders with an up-to-the minute overview of compliance results.

Please contact us for further information on: Tel: 020 3965 2166 or hello@ruleguard.com.

Webinars:

Ruleguard hosts regular events on a various regulatory topics.

To register your interest or learn more about our 2023 events, please click here.

White Papers:

Request a complimentary copy of our White Paper: Guide to the FCA's Strategy click here.

Further resources:

See our blog page for further articles or contact us via hello@ruleguard.com.

Visit our website to find out more about how Ruleguard can help: https://www.ruleguard.com/platform

Contact the author

Head of Client Regulation| Ruleguard

.png?width=400&height=166&name=webinar%20-%20Client%20asset%20protection%20(1).png)

.jpg?width=400&height=166&name=shutterstock_2450801853%20(1).jpg)

.png?width=400&height=166&name=Compliance%20Monitoring%20White%20Paper%20(1).png)