%2024%20(1).png?width=150&height=161&name=Recognised%20CPD%20Badge%20(transparent)%2024%20(1).png)

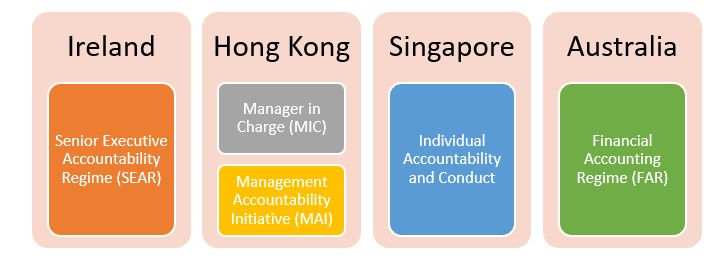

Whilst different jurisdictions have their own regulatory frameworks, there are some common approaches to overseeing the financial sector. Luckily for us the UK regulators are seen as setting the standards in regulation.

For example, regulators look to the UK’s implementation of SMCR, its standards and lessons learned to inform their own regimes. That’s great news for any international firms looking for efficiencies in their processes.

Several supervisory bodies have either implemented, or are consulting, on how to achieve greater accountability from senior managers and other risk takers within firms.

Australia’s anticipated Financial Accounting Regime (FAR) builds upon the existing Banking Executive Accountability Regime (BEAR). FAR will apply to a wider group of regulated firms using a phased approach. It may also include subsidiaries and significant related entities, so impacting the group structures. The FAR regime introduces new responsibilities such as an end-to-end product accountability allocated to a senior manager. Perhaps this is another opportunity to review your product governance arrangements under MiFID and see what you can leverage.

Meanwhile in New Zealand, the existing conduct guidance is scheduled to be reviewed with a consultation planned for Q1 2023.

Singapore’s regime focuses on improving culture and promoting good conduct. For example, firms need to have the appropriate remuneration schemes and fitness and propriety processes in place.

Common focus:

The purpose of the various accountability regimes is to build trust and ethics. The supervisors aim to do this by some common actions:

- Identifying responsible individuals who manage core functions

- Assessing individuals’ fitness and propriety (probity) for their roles and responsibilities

- Holding individuals responsible for their staff’s actions and conduct of business

- Reviewing governance structure to aid transparency and clear reporting lines

- Overseeing material risk takers by assessing fitness and propriety with appropriate governance and remuneration processes

- Ensuring corporate structure supports good conduct

There are also some common characteristics relating to the core functions or those senior individuals appointed by the firm. These include:

- Overall management oversight (e.g., CEO, Chairperson)

- Key business line (e.g., key decision maker of a business service)

- Operational control and review

- Risk management

- Finance and accounting

- Information technology

- Compliance and

- Anti-money laundering and counter-terrorist financing.

Reporting:

The similarities don’t end there. Firms are required to submit information to their supervisory body or have it available upon request. Firms are also required to notify the supervisors of changes regarding the accountable individuals. Individuals must have a clear understanding of their responsibilities which requires training. These individual responsibilities need to be mapped, documented in Terms of Reference and individual job descriptions. All of this requires good recordkeeping and maintenance to ensure timely notifications are made.

International firms should review any lessons learned from UK projects. Taking a holistic approach, firms should also consider how they can share data to keep both individual boards and parent companies aware of any risks.

How Ruleguard can help you:

Ruleguard is an end to end platform that enables firms to log and manage regulatory risks. Ruleguard has been designed to help firms demonstrate and evidence compliance, by using its comprehensive rules-mapping, risk and control tools, automated reporting features and powerful dashboards.

Get in touch with the Ruleguard team to learn more on: 020 3965 2166 or hello@ruleguard.com

Further resources:

See our blog page for further articles or contact us via: hello@ruleguard.com

Visit our website to find out more about how Ruleguard can help:

Webinars

Ruleguard hosts regular events. To be added to our mailing list click here.

Contact the author

Head of Client Regulation| Ruleguard

.png?width=300&height=175&name=webinar%20featured%20image%20April%2025%20-%20How%20can%20firms%20improve%20compliance%20monitoring%20v1%20large%20(5).png)

.png?width=300&height=175&name=webinar%20featured%20image%20April%2025%20-%20Avoid%20the%20pitfalls%20proactive%20compliance%20monitoring%20v1%20large%20(1).png)